Big Tech’s entry into financial sector poses threats that should be tracked company by company, BIS’s Carstens says

27 January 2021 00:00 by Neil Roland

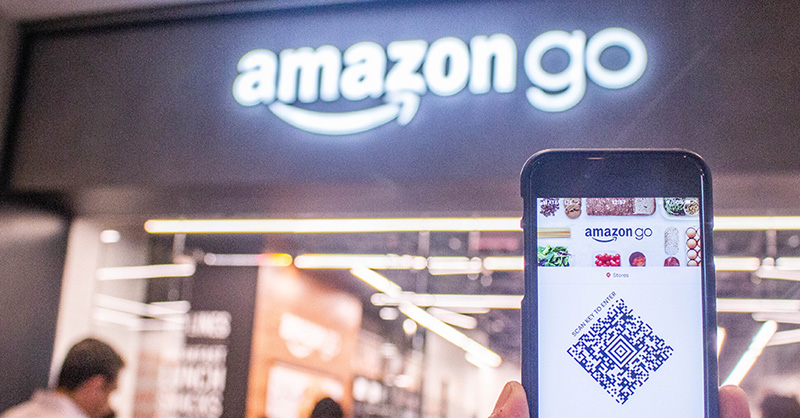

The financial-sector entry of technology giants such as Amazon, Facebook and Alibaba poses financial stability, competition and privacy threats that should be addressed through company-by-company oversight rather than just the activities in which they participate, said Agustin Carstens, Bank for International Settlements general manager.

"It is clear that big techs put policymakers in a thorny position," he said in the text of a speech posted.

Big Tech’s main risks have to do with their business model that “combines different activities (e-commerce, financial service providers, cloud computing, etc.) and their large size (systemic importance). Those risks can hardly be addressed by a piecemeal activity-by-activity approach,” his text said.

Activities-based regulation pushed by the banking industry and some regulators, including the BIS’s own 2019 annual report, is based on the premise that if Big Tech engages in activities virtually identical to those of banks, those activities should be subject to banking rules.

Cloud computing offered to banks by Amazon Web Services, Microsoft Azure and Alphabet’s Google Cloud, among others, drew Carstens’ specific attention.

Safeguards should be considered, he said, to assure the operational resilience of these third-party tech giants that banks are increasingly relying on for data storage.

— Entity-based approach —

Carstens said an entity-based approach to large technology companies in the financial sector could “help to mitigate competitive distortions between banks and non-banks.”

The EU and China have already begun initiatives with elements of this approach, and a US House antitrust panel report last fall recommended ways to regulate Big Tech to reduce anticompetitive conduct.

“It is likely that the Biden administration and Democrat-controlled Congress will be more aggressive on antitrust regulation of big techs,” Carstens said.

Related Articles

No results found