Compliance risks loom for China's semiconductor merger decisions as new US export controls take effect

01 November 2022 09:31

China’s semiconductor industry is grappling with the implications of stricter export controls imposed by the US, where new rules have triggered significant concerns about compliance risks for China’s merger decisions in the much-watched semiconductor sector.

Ensuring domestic supply commitments are maintained has been a key condition in China’s merger decisions for semiconductors but the new US export controls may jeopardize those provisions.

On Oct. 7, the US Commerce Department announced new export control rules containing a wider range of restrictions on China’s access to advanced computing chips, its ability to develop and maintain supercomputers, and manufacture advanced semiconductors.

Although it is not the first time the US has targeted China’s technology sector, the new restrictions have triggered rising anxieties in the semiconductor-related industry.

While some stakeholders are discussing options to request more structural conditions to address supply remedies that may be redundant because of the expanded control list, notification lawyers say it will be hard to bypass the restrictions through divestitures because the sophisticated US controls also involve intellectual properties and personnel.

It is understood evaluating the implications of the US export controls has been assigned to several government agencies, including the country’s top competition agency, the State Administration for Market Regulation, or SAMR.

SAMR is now reviewing existing remedies and checking whether those with supply-related conditions have been impacted by the US export rules, it is said.

Supply commitments in SAMR’s decisions

Supply commitments are commonly used as behavioral conditions in SAMR’s remedy cases involving semiconductors.

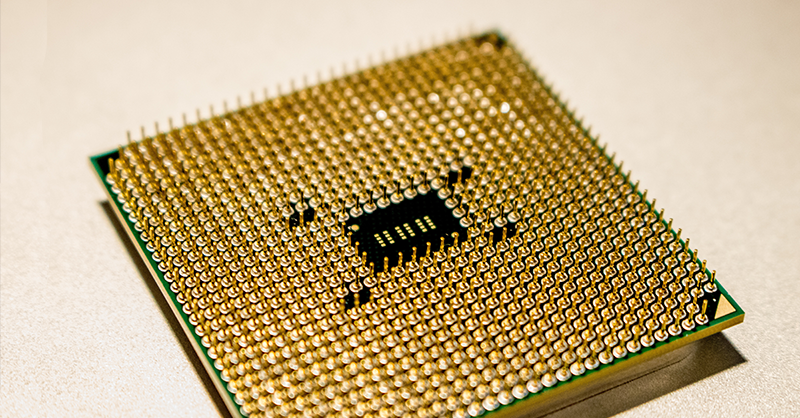

In this year’s AMD-Xilinx case, the merging parties were required to advance existing cooperation with Chinese companies and continue to supply AMD’s CPUs and GPUs, Xilinx’s FPGAs, as well as related software and accessories to the Chinese market on fair, reasonable and non-discriminatory, or FRAND, terms.

Similar provisions were also seen in the conditions imposed on Nvidia’s takeover of peer Mellanox Technologies.

SAMR ordered the companies to continue to supply, on FRAND terms, Nvidia’s GPU accelerators, Mellanox’s high-speed interconnection devices, and related software and accessories to the Chinese market .

Back in 2019, China’s top merger control regulator also imposed conditions on the acquisition of Israeli’s Orbotech by US semiconductor equipment maker KLA-Tencor.

KLA-Tencor, Orbotech and the combined entity must continue to provide, on FRAND terms, semiconductor process-control equipment and related services to Chinese manufacturers of deposition and/or etching equipment, according to the merger decision.

However, lawyers also noted that supply remedies may not inevitably be impacted by the export control rules, because the US is only targeting advanced technologies.

Responses from the sector

China Semiconductor Industry Association, or CSIA, consecutively released two statements in response to the ambition by the US to curb the development of China’s strategic semiconductor sector.

On Oct. 13, it said the new rules abruptly disturb international trade in an arbitrary way. It also urged the US government to adjust its course of action and return to negotiations under the framework of the World Semiconductor Council and the Government/Authority Meeting on Semiconductors.

About two months earlier, the same association issued a statement saying the US’ CHIPS and Science Act deviates from the shared principle of being fair, open and non-discriminatory.

-Analysis by Yang Yue and Sachiko Sakamaki

Related Articles

No results found